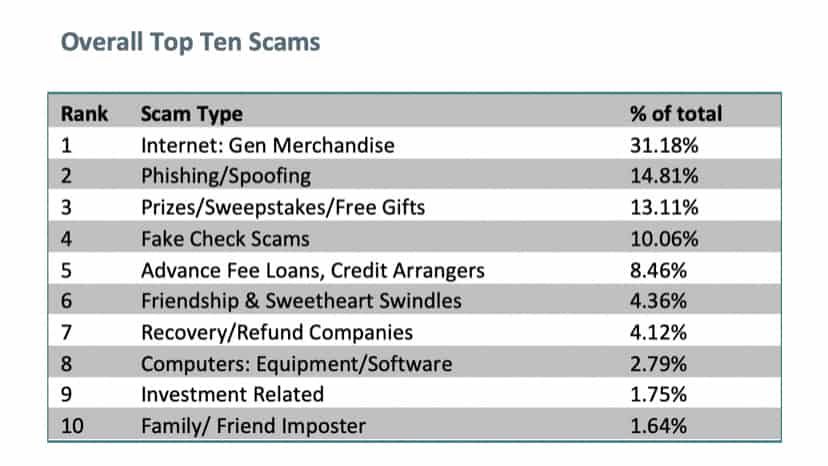

Top 10 Scams of 2019, per Fraud.org

To commemorate National Consumer Protection Week (March 1-7), the National Consumer League’s Fraud.org breaks down the worst offenders.

Before I share the link to Fraud.org’s report, I don’t want to bury the lead. The most interesting part of it: scammers are dumping wire transfer as the most common method of tricking consumers into giving up their money. The most common method now, according to Fraud.org, is through credit cards.

Although that’s not necessarily good news, it is encouraging because it indicates consumers, including seniors, are getting wise (pun intended) to wire transfer requests as a dead giveaway of scams. Sure, credit cards are now more at risk, but at least we enjoy the built-in security measures of our credit cards. Under federal law, you’re never liable for more than $50 of any disputed credit card charge. Most credit cards offer zero liability (no responsibility for ANY disputed charge) as an incentive feature, so credit cards are still the most ironclad method of currency. If you can be disciplined with them, you’re better off using your credit card for every transaction, then paying it off in each billing cycle. You’ll secure every transaction while boosting both your debt-to-credit ratio and your credit score.

Having said that, many of you are still falling for the same greatest hits of scams that have haunted consumers for decades. That should stop right now, with the Top 10 scams of 2019 from the National Consumer League and Fraud.org. Please click on that link for the report and Get Wise.

Copyright 2020 Wise Choices TM. All rights reserved.

andy wise, andy wise choices, andy wise memphis, consumer protection, fraud, national consumer league, national consumer protection week, scams, top scams 2019, wise choices