New scam packs a 1-2 punch at the gas pump

Combining two of identity thieves’ greatest hits, this scam starts at the gas station.

Mark Huffman, consumer news reporter for ConsumerAffairs.com, broke the news on this latest card-skimming scam in his July 1 story. “A criminal installs a ‘skimmer,’ usually on a gas pump, to steal credit or debit card information — everything but the CV2 security code on the back of the card,” wrote Huffman. “To get the code, the scammer or an accomplice uses spoofing technology to call the cardholder and pose as someone from the bank or credit card company that issued the card.”

Caller ID spoofing is when a scammer manipulates your caller ID to make the call appear to come from your bank or credit card issuer. The scammer can program the call to make your caller ID show not only your bank or card company’s name, but also its accurate customer service number. In this latest trick, once the scammer has somehow connected your card information to your phone number, he’ll call you, spoof the caller ID and ask for your 3-digit CV2 code.

“The caller tells the victim that their account has been compromised — which is actually true — but the CV2 security code is needed to freeze the account,” Huffman wrote. “If the victim provides that missing information, the scammer then has an active card that can be used to make purchases, withdraw money, or sell on the black market.”

Now here’s the thing: your bank or credit card-issuer is NEVER going to call you to request the CV2 number on the back of your card. It issued that card and code to you in the first place!

Also, most banks and card-issuers will provide their customers multiple security options – either a text or email, NOT a call – when suspicious activity occurs. The customer typically elects the option, not the bank or card-issuer — and if there’s unusual activity, customer service won’t ever ask you to verify a card number or code. It’ll simply cancel the card and issue you a new one.

You should never use a debit card at a gas pump. Besides the risk of fraud, many pumps will automatically hit your card with what’s called a pre-authorization. It’s a temporary fee to determine whether there’s enough funds in your account to cover the gas purchase. Banks who issue pre-authorizations often don’t credit them back for up to three days, so you risk over-drafting your account when you use a debit card at a gas pump.

Huffman and I offer these tips to avoid this card-skimming, call-spoofing scam:

-

Pay with cash or a credit card with chip technology instead of a debit card

-

Monitor your bank and credit card statements regularly for strange charges

-

Report unauthorized charges immediately

-

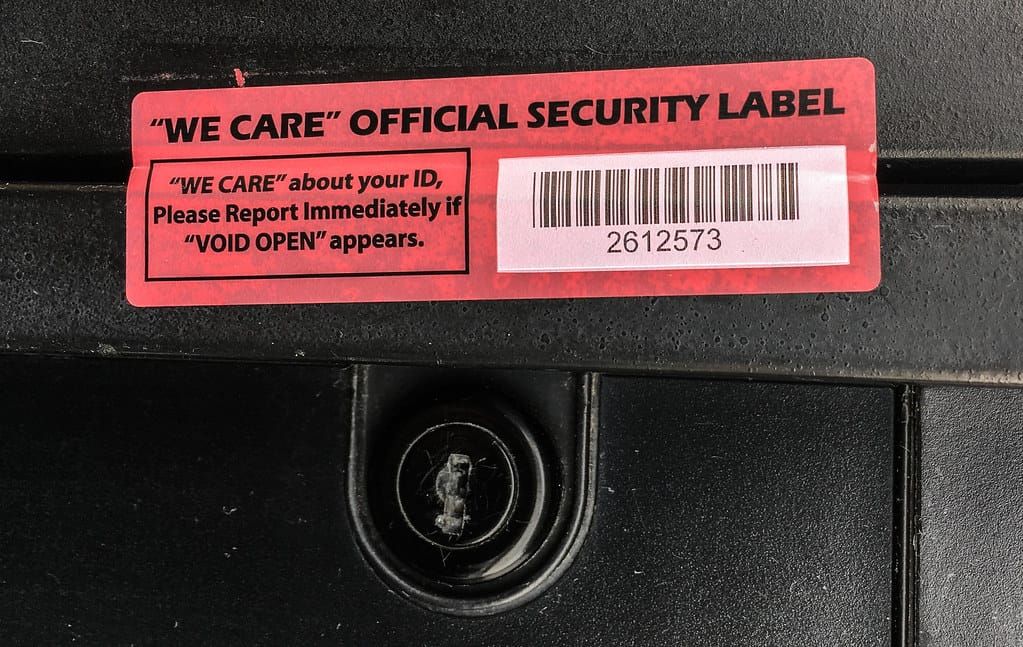

Inspect card readers, especially at gas pumps and ATMs, to see if a skimming device is placed over the card reader or if the security seal is broken. At ATM’s, give the card-reader a gentle shake. Try to move it. A legitimate card-reader should not move. If it does, someone has likely tampered with the ATM and installed a skimming device. Vigilant gas stations use security stickers (pictured above) placed across the seam of the locked door where the card-reader is installed in the pump. Inspect that sticker. If it is breached or torn, a scammer may have tampered with it.

- Never respond to a phone call from someone who claims to be from your credit card company. Instead, hang up and call the toll-free customer service number on the back of your card. It’s better to initiate contact with someone you’re certain represents your financial institution, then ask that representative about the possibility of unusual account activity.

Copyright 2019 Wise Choices TM. All rights reserved.

andy wise, andy wise choices, andy wise memphis, caller ID spoofing, card skimmers, consumer affairs, consumer investigator, consumer protection, credit cards, cv2, cvv codes, debit cards, identity theft, security codes, skimmers, wise choices